When it comes to the stock market, volatility is often painted as the villain in the narrative of investing. This fear, however, misses a critical point: volatility is a feature, not a bug. Understanding this can fundamentally change how we approach investing and build our wealth.

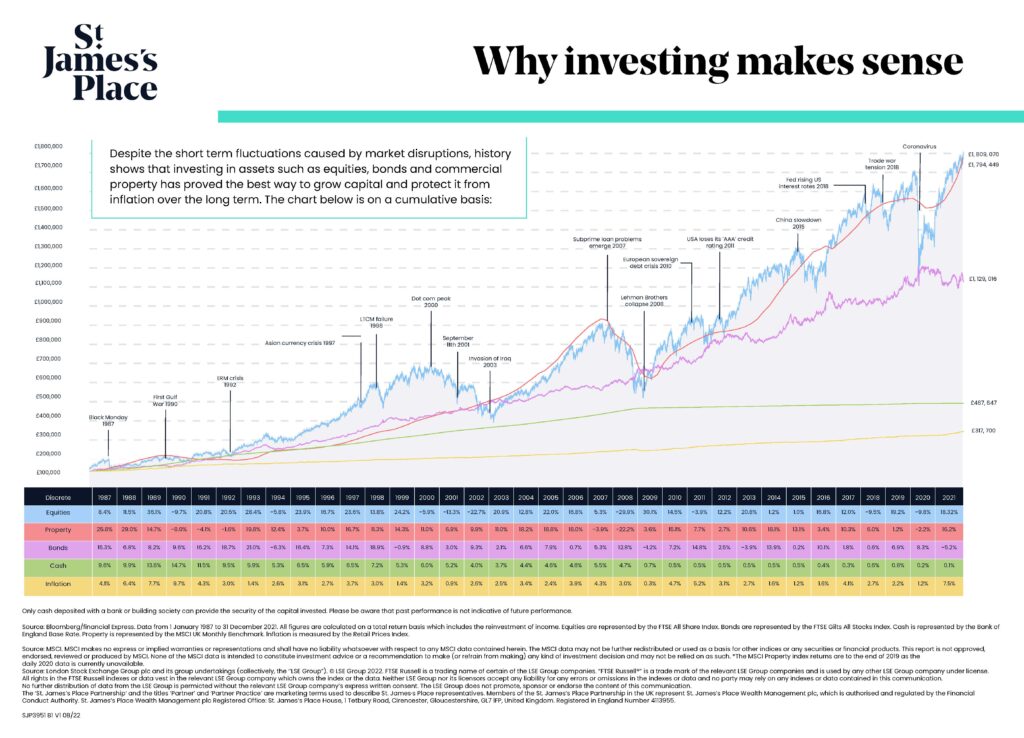

Markets fluctuate. This is not a design flaw but a fundamental characteristic. Economic cycles, political events, technological advances, and shifts in investor sentiment all play a role. From Black Monday in 1987 to the COVID-19 pandemic in 2020, history is full of episodes that have caused sharp market declines. Yet, these events, while dramatic, are part of a larger story of growth and recovery.

Consider the long-term performance of the FTSE All-Share Index. Despite numerous downturns, this index representing UK equities has consistently outperformed other asset classes such as bonds, cash, and property over the long haul. This illustrates a vital point: short-term volatility is a distraction from the broader trend of long-term growth.

Let’s delve into the data. If you had invested £100,000 in UK equities back in 1987, despite the market crashes and economic crises along the way, your investment would have grown significantly by now. The “Why Investing Makes Sense” graphic beautifully captures this journey, showing a robust upward trajectory despite intermittent drops.

Each market drop—whether during the dotcom bust, the 2008 financial crisis, or the COVID-19 pandemic—was followed by recovery and growth. This pattern isn’t an anomaly but a testament to the market’s resilience. Over time, the ups outweigh the downs, driving substantial long-term returns.

Investors often let short-term volatility dictate their actions, reacting with fear and making impulsive decisions. However, understanding that these fluctuations are part of the market’s nature can shift this perspective. Instead of viewing market dips with trepidation, see them as opportunities. The key is maintaining a long-term perspective and staying the course during turbulent times. By understanding and accepting the nature of volatility, investors can navigate the market with confidence and build enduring wealth.

Now, just because we know that stock markets fall and rise in value, it doesn’t always mean it’s the easiest thing to deal with. Seeing the value of our pensions or investments drop is naturally uncomfortable. So here are tips for dealing with volatility:

- Diversify your investments: Spreading investments across different asset classes tends to reduce risk and volatility in tandem

- Focus on quality investments: Ensure your portfolio is invested in high-quality assets

- Have a plan and stick to It: Define your goals and risk tolerance, and in times of high volatility refer back to your plan

- Use pound-cost averaging: Invest a fixed amount regularly to mitigate the impact of volatility

- Seek professional advice: Consult with your financial adviser for tailored guidance and objective perspectives on what is going on in the market

- Hold some cash: The power of investing is in leaving your investments alone and allowing them to grow over time. Holding some funds in cash can provide the confidence to avoid withdrawing from your investments during market volatility, which might end up being the best investment you ever make

Find out more about our Financial services here.

| Andy Gray Financial Adviser, GGFM | ||||

|