By Andy Gray

May 6, 2025

When it comes to the stock market, volatility is often painted as the villain in the narrative of investing. This fear, however, misses a critical point: volatility is a feature, not a bug. Understanding this can fundamentally change how we approach investing and build our wealth.

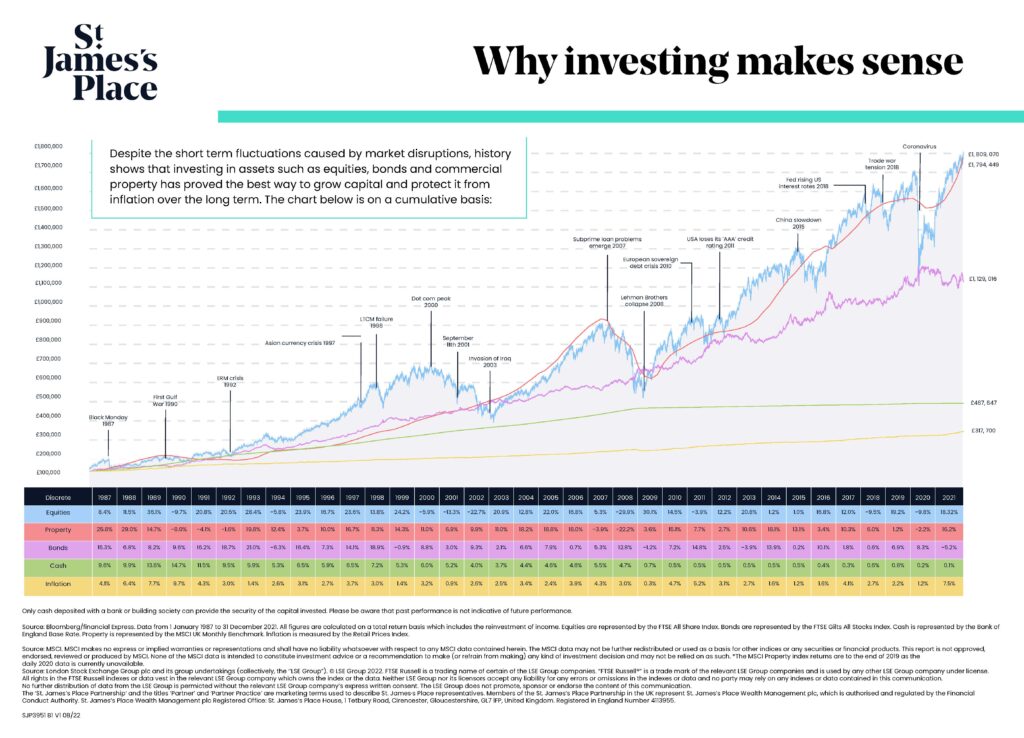

Markets fluctuate. This is not a design flaw but a fundamental characteristic. Economic cycles, political events, technological advances, and shifts in investor sentiment all play a role. From Black Monday in 1987 to the COVID-19 pandemic in 2020, history is full of episodes that have caused sharp market declines. Yet, these events, while dramatic, are part of a larger story of growth and recovery.

Consider the long-term performance of the FTSE All-Share Index. Despite numerous downturns, this index representing UK equities has consistently outperformed other asset classes such as bonds, cash, and property over the long haul. This illustrates a vital point: short-term volatility is a distraction from the broader trend of long-term growth.

Let’s delve into the data. If you had invested £100,000 in UK equities back in 1987, despite the market crashes and economic crises along the way, your investment would have grown significantly by now. The “Why Investing Makes Sense” graphic beautifully captures this journey, showing a robust upward trajectory despite intermittent drops.

Each market drop—whether during the dotcom bust, the 2008 financial crisis, or the COVID-19 pandemic—was followed by recovery and growth. This pattern isn’t an anomaly but a testament to the market’s resilience. Over time, the ups outweigh the downs, driving substantial long-term returns.

Investors often let short-term volatility dictate their actions, reacting with fear and making impulsive decisions. However, understanding that these fluctuations are part of the market’s nature can shift this perspective. Instead of viewing market dips with trepidation, see them as opportunities. The key is maintaining a long-term perspective and staying the course during turbulent times. By understanding and accepting the nature of volatility, investors can navigate the market with confidence and build enduring wealth.

Now, just because we know that stock markets fall and rise in value, it doesn’t always mean it’s the easiest thing to deal with. Seeing the value of our pensions or investments drop is naturally uncomfortable. So here are tips for dealing with volatility:

Find out more about our Financial services here.

| Andy Gray Financial Adviser, GGFM | ||||

|

Andy Gray is a dedicated Financial Adviser at Gilson Gray Financial Management, with a robust background in financial advisory and investment research. With a diverse career spanning financial services, property management, and ski instruction, Andy brings a wealth of knowledge and a unique perspective to his role, focusing on tailored financial strategies to help clients achieve their financial goals.