May 22, 2025

It was apparent that from the start of the Covid-19 epidemic, the level of literature from both the government and governing bodies, whilst informative, and very much necessary, could be overwhelming and too much to digest for some clients. As a result many clients reached out to us for guidance and direction.

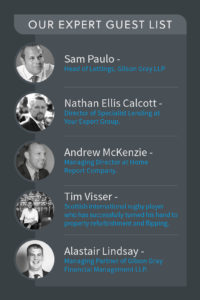

We decided, therefore, to create the Gilson Gray Property Investor Club, to give our clients direct access to key individuals within various

property related sectors and take advantage of these key relationships that we have fostered over the years.

Within this forum, like-minded individuals could discuss the key points and considerations within various property related sectors.

We did this by getting everyone together on Zoom last Thursday for our first ‘round table discussion’ but in safety their homes.

Summary of Q&A points from Nathan Ellis Calcott

Many lenders have been withdrawing from the short term lets markets. Those who are still active are not considering historic income from that market and are only looking at traditional PRT lease income.

Existing agreements have become subject to further review in line with the new KYC due diligence and lenders LTV requirement being placed at 60-75%. As a result, where they do not adhered to more stringent stress testing, some historic agreements in principle are not being honoured.

Lenders are increasingly examining the borrower’s track record and experience within the buy-to-let market. As such a trend is emerging where there is less appetite to lend to first time landlords. This is even more that case against more specialist landlord products like HMOs. Income considerations against HMOs is also linked to the income of more standard PRT lets, similar to the commentary on short term lets products. As such there is a strong weighting on income behind assets.

Nathan would suggest to everyone that 6 months prior to the end of their fixed term they should look at their financial position, get their house in order and assets what products are out in the market place.

Summary of Q&A points from Andrew McKenzie

What rhetoric and is coming out from RICS (specifically with regards to these new clauses surrounding post covid valuations)

In short, the RICS are obviously very concerned with the current situation with regards to protecting the interests of its members, and the general public through the Royal Charter, which requires a duty of care from all RICS Members to the general public.

Access to evidential data such as comparables may also be less freely available.

Regulated Members have been considering whether a material uncertainty declaration is now appropriate. RICS Regulated Members should be fully aware of VPGA 10 and VPS 3 within the RICS Red Book Global Standards in the decision-making process. If material uncertainty is declared, surveyors are reminded that this should be explicitly stated

In conclusion

“Where a material uncertainty clause is being used, its purpose is to ensure that any client relying upon that specific valuation report understands that it has been prepared under extraordinary circumstances.

“The term is not meant to suggest that the valuation cannot be relied upon; rather, it is used in order to be clear and transparent with all parties, in a professional manner that – in the current extraordinary circumstances – less certainty can be attached to the valuation than would otherwise be the case. Indeed, with regard to the process itself, professional valuers will almost certainly have undertaken far more due diligence than normal, in order to arrive at their estimate of value.”

What key factors do you anticipate effecting how properties are valued post Covid-19?

Obviously no one has a crystal ball, we all thought the 2008 banking crisis was about as bad as it could get, however no one could have foreseen a threat like COVID-19.

At present the market is only suspended. It is a temporary situation. The underlying fundamentals have not changed or worsened. All the mechanics are still there.

Before this out break the market was strong there was a shortage of supply of property, there was pent-up demand and good prices were being achieved.

The housing market is not strangled as it was in 2008, where lending sources were significantly reduced, and lenders criteria was restrictive.

Whether we see a V-shaped or a U-shaped recession, the general consensus is that lenders are in a far better position this time round, with decent cash reserves in place, and therefore should be in a position to carry on as normal post Covid-19, however this will be dependent on how long the situation continues.

The main thing to consider in the recovery will be the time of the year that restrictions are lifted. Early summer, there will be still c6 months of the year to go and the normal focus on holidays may not prove so much of a distraction. The longer we progress into the year with the current statuesque the more concerning a possible recovery is, due to entering the winter, and the pencilled in Brexit “D” date set for December (who knows if this will remain) will result in the public focus being on other aspects rather than moving.

In short I am not anticipating any significant reduction in house prices. The likes of Savills and Knight Frank have reported estimates of anything between 5 and 15% reduction, however this is UK wide, and Edinburgh is and has always been its own market. The barriers we saw to a return to everyday life in 2008 are not there. The lack of supply has not changed from what it was prior to the Covid 19 outbreak, demand will hopefully remain every bit as strong, though it might be slightly dampened initially.

Are you still able to do valuations of properties that are occupied?

As per The Scottish Governments document – Coronavirus (COVID-19): guidance on moving home, dated 31st March 2020

Surveyors

Surveyors should follow the latest Scottish Government guidance and may continue to support the residential property market if they can do so in a way which is fully consistent with the social distancing advice.

In the short term some lenders are accepting desk top valuations, however this is on a case by case basis, and lender by lender basis.

Ally Lindsay – GGFM – Investment Commentary

Ally provided great insight on options available to bridge short term liquidity issues. Two specific tools were highlighted.

We also discussed the importance of Diversifying assets – crucial to financial success coupled with having a robust emergency fund to meet short term cash needs.

We had a useful discussion on the type of recovery we could expect coming through the crisis and this was covered in one of our recent articles:

Gilson Gray Financial Management

Key considerations

Registers of Scotland

One of the most significant elements that underpins all of the above commentary is the ability of the Registers of Scotland to re-open and clear the back logged of transactions that are waiting to be processed.

The Registers of Scotland confirmed on 24th April that their digital submission service will be operational as of 27th April. They note;

“For transactions that can’t be delayed, we have been working on a range of digital submission solutions to support the Scottish property market.

We are pleased to report that we have successfully completed user testing on our new digital process for the submission of applications.”

Furloughed Staff.

Movement and momentum will be affected by the ability of surveyors, conveyancing lawyers and property professionals who have been furloughed, to return back to work.

V versus U curve recovery

Positive movement within the property market will depend on how the economic recover curve plays out. Historically in event driven bear markets the period of recover tends to be shorter, leading analysts to initially predict a V curve recovery, with general commentary being on growth being visible by the end of the year.

Concerns over a potential spike in unemployment levels and the significant impact on the leisure and hospitality industry, has led recent market commentary to align with a bias towards a U curve recovery, which will see a more prolonged return back to growth.

If you’d like to join our next event please get in touch – Sam Paulo spaulo@gilsongray.co.uk. or call 07795463590

The information and opinions contained in this blog are for information only. They are not intended to constitute advice and should not be relied upon or considered as a replacement for advice. Before acting on any of the information contained in this blog, please seek specific advice from Gilson Gray.

Marcus is a former international rugby player and CIH level 3 qualified in Letting Property Management. He currently specialises in portfolio management, existing client relationships and new business.