May 27, 2025

In the last tax year (2019/20), bereaved families paid some £5.2 billion in Inheritance Tax (IHT).

However, while many people are aware of strategies that can reduce their IHT liability, such as gifting, they may be less aware of how some employee perks – including workplace pensions and death-in-service benefits (whereby a nominated beneficiary receives a lump sum if you die while in service with your employer) – could be storing up problems for their families in the future.

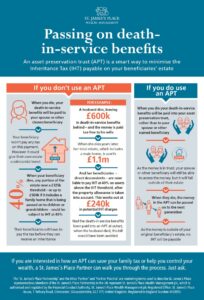

Death-in-service benefits or pensions that are paid as a lump sum to a beneficiary after the death of the benefit holder will form part of that beneficiary’s estate – and IHT may become payable.

Currently, IHT is charged at a rate of 40% on the portion of the estate over a £325,000 threshold, or up to £500,000 if it includes a family home that is being passed on to children or grandchildren. However, transfers between spouses and civil partners are tax-free.

Death-in-service benefits are often multiples of salary, so even for those who don’t currently have any issues with IHT, a payment from one of these schemes can be as much as, if not more than, the nil rate band i.e the £325,000 threshold.

Preserving your clients’ assets

The problem can, however, be avoided with the use of an asset preservation trust (APT). APTs are designed for the purpose of holding death-in-service and pension death benefits in such a way as to have the funds accessible to beneficiaries while keeping them outside their estate for IHT purposes. By paying the lump sum into the APT on death, it will avoid it falling into the surviving beneficiary’s estate and so being subject to IHT, while giving the beneficiary access to the capital should they still need it.

If you would like further information on the topic discussed in this blog, please contact:

Louise by email: lbrotherston@gilsongrayfinancial.co.uk

The information and opinions contained in this blog are for information only. They are not intended to constitute advice and should not be relied upon or considered as a replacement for advice. Before acting on any of the information contained in this blog, please seek specific advice from Gilson Gray Financial Management.

Louise started working with Gilson Gray Financial Management in September 2020.